Gladiathor/iStock via Getty Images

Investment Thesis

Flooring & Decoration (NYSE:FND) is a hard-surface flooring retailer and distributor of commercial flooring with 191 warehouse-format stores and six small design studios in 33 states. With an experienced management team, the company lays out expansion plans to drive future store base growth by 20% per year. This gave FND the runway to grow into the next home improvement retail giant.

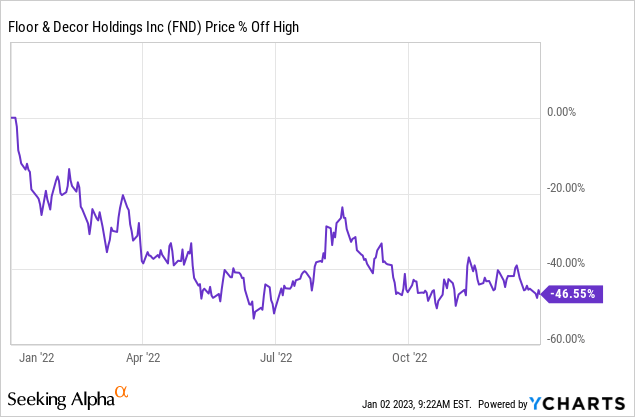

FND has also performed well financially over the last few years. Earnings per share rose 64%, and EPS jumped 83% from 2019 to 2021. However, FND is down more than 50% from its all-time high in December 2021 and has had a disappointing performance in 2022 due to the depressed housing market. This allows investors to buy these amazing growth companies at a significant discount in my opinion. So, I rate FND a “Strong Buy”.

Winning Business Model

A team of experienced executives, including Chief Executive Officer Tom Taylor, manages FND. He has 23 years of experience at The Home Depot (HD) and helped expand his store base from 15 to more than 2,000. FND is in an early growth stage. His valuable experience provides an excellent guide to FND scales.

FND warehouse format store provides one-stop service for their customers to shop for hard surface flooring materials and related tools and materials. The company offers products from more than 60 proprietary brands and approximately 4200 stock holding units (“SKUs”) in each store, much larger than any other floor retailer. As a customer, an integrated store like FND is something I yearn for. This saves a lot of time from traveling between stores to looking for flooring materials in different styles and brands.

Flooring & Decoration

In addition, the focus on Pro customers gives the company a competitive advantage. Although Pros account for only 40.7% of total sales, they tend to frequent the store more, and their professional opinion often influences homeowners’ choices. As such, FND offers a dedicated Pro sales force in each store to help the Pro shops more efficiently. In addition, to increase their loyalty to FND and engage new Pro customers, the company launched a Pro loyalty rewards program. In the most recent earnings call, management provided some encouraging numbers in regards to the Pros:

Pro transactions were up 7% during the quarter, and our top 10% of PPR members are spending 24% more than they did a year ago. If you think about the 185 stores in the very tough macro to be able to sign up another 29,000 Pros over the course of the quarter, that’s great for the long term.

E-commerce is relatively less important to retailers of hard surface flooring materials as customers may wish to have a hands-on experience to get a feel for the texture and material of the flooring materials. Only 16% of total sales come from e-commerce channels. But FND is still excited to grow its online platform as it assists customers in exploring design options and enriches the overall shopping experience.

With a wide range of products, a professional sales team and an experienced management team, the company achieved an impressive 14.2% annual comparable store sales growth over a thirteen year period (2009 – 2021) and 12.6% growth from 2017 – 2021.

The Next Home Depot?

FND operates in the large but fragmented US floor coverings market, having an estimated manageable market size of $30 billion. Hard surface flooring materials have recently gained popularity, partly due to better cleanliness and greater durability. The market size is about $41 billion if related tools and materials are included.

Currently, FND has only 197 stores and studios, which is less than a tenth of the number of Home Depot stores. Because the floor coverings market in the US is highly fragmented, FND still has a broad and long foundation to grow as one of the largest home improvement retailers in the US. Management estimates that FND only represents 8% of the total manageable market.

To gain market share, the hard floor coverings retailer has expansion plans to grow its store base by 20% annually over the next few years in new and underserved markets. Expansion to at least 500 stores nationwide over the next 8 to 10 years is anticipated. The company shows that aggressive plans can be achieved this year. They opened 32 new warehouse stores across the US, a 20% increase from last year’s number of stores.

The performances from the newly opened store are already promising. All new stores are profitable in their first year and achieve better comparable store sales growth than existing stores.

In addition to FND’s expansion plans to gain market share from this fragmented sector, the pending 2023 recession may also be a good opportunity to increase market share. A small, debt-ridden floor covering company may be forced to close under a challenging economic backdrop. The FND balance sheet must be healthy enough to survive a recessionary environment. And will most likely be able to swallow the released market share of those who can’t get through the tough times.

The company is on the runway to expand its business to 500 stores this decade. The hard surface floor covering industry is growing by 4% per year. Given its fragmented nature, it’s no wonder that this well-managed company continues to gain market share and become the next home improvement retail giant like Home Depot.

Solids Balance

Acquisition activities and aggressive store expansion plans can put pressure on a company’s balance sheet as the latter incur significant pre-opening costs (eg construction costs, training costs, advertising costs). Especially the company’s capital expenditure trend has increased in recent years.

However, I find FND’s balance sheet to be quite solid, and its expansion plans won’t have a negative impact on its financial performance. FND is now $374 million in debt as of Q3 2022, with most of the debt due after 2026. The amount owed is only slightly more than the value of equity. A summary of the financial strength ratios is presented below for easy reference.

Debt to Equity Ratio | 1.05 |

Debt to Asset Ratio | 0.39 |

Equity to Asset Ratio | 0.37 |

(Source: Author, data from Gurufocus)

Potential Risk

Tile styles and hard floor materials are like the clothes in your closet. They will change seasonally. Therefore, the increased inventory level is a concern to me, as older style floor coverings can become obsolete. There is a risk that the company will lower prices to remove redundant and out-of-date inventory. Inventory levels doubled from $654 million in 2020 to $1,320 million in TTM. High levels of inventories also saw operating cash flow fall sharply in the first three quarters of 2022. At the same time, free cash flow fell to negative levels in the same period.

However, the sharp growth in inventory levels to some extent reflects the frequent opening of new stores and new in-store products. As explained in the latest earnings call:

Inventory growth is in line with our expectations and reflects our new store growth. We’ve been working to increase stock inventory, inflation and the addition of innovative new SKUs.

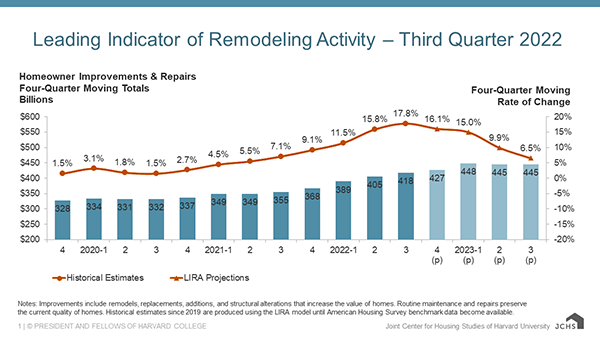

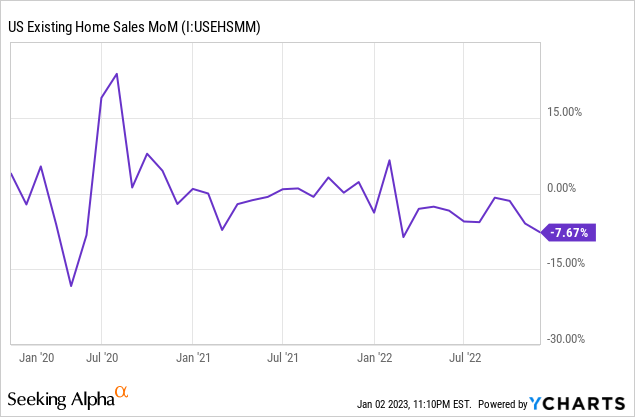

The second concern is a decline in existing home sales and home improvement incentives. Existing home sales data fell for eleven months in a row (since February 2022). And the Leading Indicator for Renovation Activity predicts home repair and maintenance spending will peak in the second quarter of 2023, and its growth rate will also slow down sharply in 2023. We can conclude that disappointing housing data is likely to lower demand for hard surface flooring materials in 2023.

Harvard University

Some might argue that a weak housing market will hit home improvement retailers like FND badly. However, even during tough times, FND still delivers strong financial results. Total sales and EPS grew 25.2% and 16.7% YoY respectively in Q3 2022. The management team is also confident in achieving comparable store sales growth for 14 consecutive years.

Assessment and Conclusion

FND has the formidable business model and management team to scale itself in the highly fragmented hard surface floor covering industry to become the next home improvement retail giant. In previous years, the stock has shown strong financial performance.

Stock is now significantly discounted. FND has a current P/E ratio of 27.09, 43% lower than the 5-year average P/E ratio. The company’s 5-year average P/E ratio makes sense as it matches its 5-year average EPS growth (42.5% CAGR).

However, the average P/E ratio is likely to decline as the Street anticipates slower growth rates in the coming years. Below are my bullish and bearish valuation cases, assuming the stock’s return to P/E ratio is 33.6 (70% of the current 5-year average P/E ratio).

| Bullish Case (EPS Growth %) | Bearish Case (EPS Growth %) | |

| 2022 | 12.2% | 8% |

| 2023 | 16.4% | 8.2% |

| Fair value | $107.50 | $96.2 |

| Implied Growth | 54% | 38% |

One additional reason to own FND is Berkshire Hathaway (BRK.A) (BRK.B) fixed their FND position in Q3 2021 and increased their position in the range of between $81 to $130. Entering at the current price will give investors a discount on Mr. Warren Buffett.

Please note that all data in this article is abstracted from the transcript of FND’s Q3 2022 conference call and 2021 annual report, unless otherwise specified.